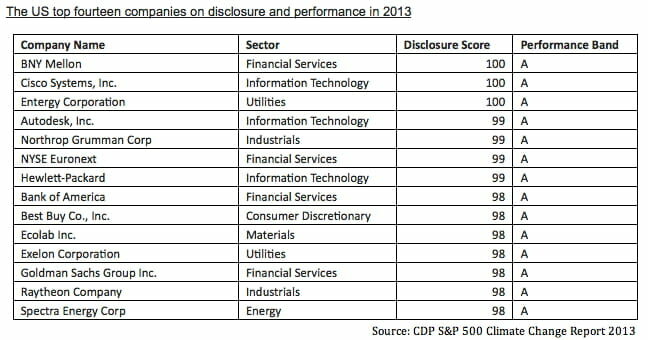

BNY Mellon, Cisco Systems and Entergy top the CDP’s annual carbon performance and disclosure ratings for the S&P 500, released today.

BNY Mellon, Cisco Systems and Entergy top the CDP’s annual carbon performance and disclosure ratings for the S&P 500, released today.

All three companies received a disclosure score of 100 — calculated to reflect each company’s transparency on climate change — and A performance ratings, which rank companies according to the scale and quality of their emissions reductions and strategies.

CDP and PricewaterhouseCoopers co-wrote the CDP S&P 500 Climate Change Report in response to CDP’s disclosure request from 722 investors representing $87 trillion. This year, 77 percent of respondents (258 companies) reported an increase in climate change exposure, up from 61 percent in 2012, with extreme weather topping the list of highest-impact.

S&P 500 companies are investing on average more than 4 percent of annual capital expenditure in emissions reductions, representing $50 billion worth of investments on a range of emissions reduction activities and energy-saving processes, the report says. The energy sector leads with a reported $27.3 billion invested, followed by utilities with $13.7 billion invested. Companies reported reducing greenhouse gas emissions on aggregate by 6.1 percent.

The report also found S&P 500 companies collectively saved $4 billion from their investments in emissions reductions, including product design innovations ($1.2 billion), energy efficiency processes ($991 million), and changes to their transportation fleet and use ($709 million).

Twenty companies generated 85 percent ($3.5 billion) of the monetary savings reported by all the respondents and 20 companies accounted for nearly 90 percent of the carbon emissions reductions. The seven companies that overlap both of these lists are Ameren, AT&T, Dell, Exelon, Northeast Utilities, Walmart and Waste Management.

Companies from the S&P 500 on the 2013 Climate Performance Leadership Index more than doubled in number from 2012, which the authors say demonstrates the significance of incorporating climate change risks and opportunities into firms’ overall business strategy.

A complementary report covering the Global 500, Linking Climate Engagement to Financial Performance: An Investor’s Perspective, also released today and co-written by CDP and Sustainable Insight Capital Management, shows that superior transparency on climate engagement is associated with higher financial performance.

Cisco and financial firm BNY Mellon — along with BMW, Daimler, Philips Electronics, Nestlé, and utility Gas Natural SDG — also topped the CDP's list of the world's best best companies in terms of climate change disclosure and performance published earlier this month. All received perfect 100 disclosure scores and A performance ratings.

Last year, Pepco Holdings, NYSE Euronext and Wells Fargo earned top spots on the CDP’s carbon performance and disclosure ratings for the S&P 500.