Governments aiming for net-zero emissions by 2050 must do more to spur the adoption of electric vehicles, according to a new report from BloombergNEF (BNEF). Electric vehicles represent a $7 trillion global market opportunity between today and 2030, and $46 trillion between now and 2050, but that won’t be enough to reach the goal unless certain measures are taken.

Governments aiming for net-zero emissions by 2050 must do more to spur the adoption of electric vehicles, according to a new report from BloombergNEF (BNEF). Electric vehicles represent a $7 trillion global market opportunity between today and 2030, and $46 trillion between now and 2050, but that won’t be enough to reach the goal unless certain measures are taken.

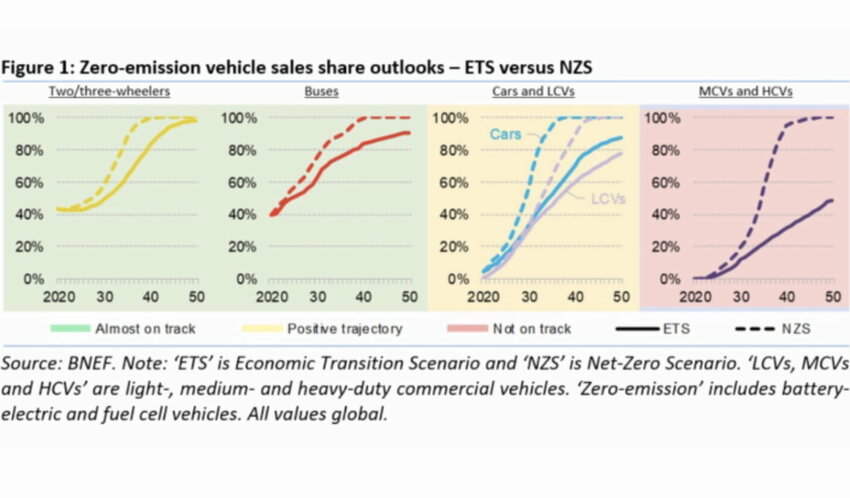

Assuming no additional policy measures, global sales of zero-emissions passenger cars will rise from 4% of the market in 2020 to 34% globally by 2030 — but that number would have to be 60% in 2030 in order for the road transport sector to reach net-zero by 2050, the BNEF Electric Vehicle Outlook finds.

Required policy measures include accelerating electric car adoption, expanding charging networks, and pushing for battery recycling and new regulations on heavy trucks. Reaching the goal would also require encouraging active modes of transportation like cycling and walking, according to the report.

The report, which for the first time examines what would be required to bring global road transport emissions onto a trajectory compatible with net zero by 2050, indicates that the recent strong growth of electric vehicles in the passenger car, bus and two-three-wheeler segments will continue and accelerate. But reaching net zero by mid-century will require “all hands on deck, particularly for trucks and other heavy commercial vehicles where the transition has barely started.”

Policy changes will be needed “very soon” to make a higher rate of penetration possible, particularly in countries that do not already have tightening vehicle CO2 emissions or fuel economy standards. “Early adoption is vital for building infrastructure and broader consumer interest,” the report says.

Urgent action is especially important in the heavy truck segment, which is “far from being on course for net zero.” In addition to introducing tighter fuel economy or CO2 standards for trucks, governments may need to consider mandates for the decarbonization of fleets. They should also consider incentives to push freight into smaller trucks, which can electrify faster than larger ones,” says Nikolas Soulopoulos, commercial transport team lead at BNEF.

Two segments within road transport —two/three wheelers, which are heavily used in developing countries, and buses — are close to being on track to hit net-zero emissions by 2050, just on the basis of established trends in relative economics.