(Credit: Pexels)

(Credit: Pexels)Originating from green bonds - now a trillion dollar industry - sustainability bonds have been growing rapidly as a way to fund key issues, including COVID-19 vaccines, climate change, biodiversity, energy efficiency measures, and more.

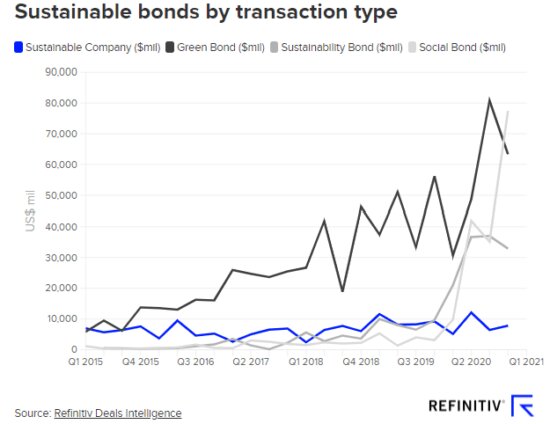

In 2020, the sustainability bond market increased eightfold, according to data provider Refinitiv. In the first quarter of 2021, sustainability bonds reached a new high of $287 billion, more than doubling the previous year’s record-breaking figures, and Moody’s projects sustainability bonds could hit more than $650 billion by the end of the year, a 32% increase over 2020. Social and sustainability bond categories each surpassed $100 billion for the first time, as sovereigns, multi-laterals and banks financed relief efforts related to COVID-19’s economic disruption.

The pandemic has accelerated the trend towards sustainability bonds and responsible investing. Increasingly, investors want to know where their money is going and ensure it is being used for responsible projects.

Earlier this year, Environment & Energy Leader reported that Kellogg, Amazon, Whirlpool, Pacific Life, Aflac, MasterCard, Georgia Power, and others issued sustainability bonds, some of which were first-time issuances.

Last year, the World Bank made an $8 billion, five-year sustainable development bond, the largest ever U.S. dollar bond issued by a supranational. Funds go towards financing the World Bank’s pledge of $160 billion aimed at helping countries with their pandemic recovery, $12 billion of which will be used specifically for vaccination efforts in developing countries. The aim is to reach 50 countries with these vaccination projects by the middle of this year.