(Credit: Avnet Abacus)

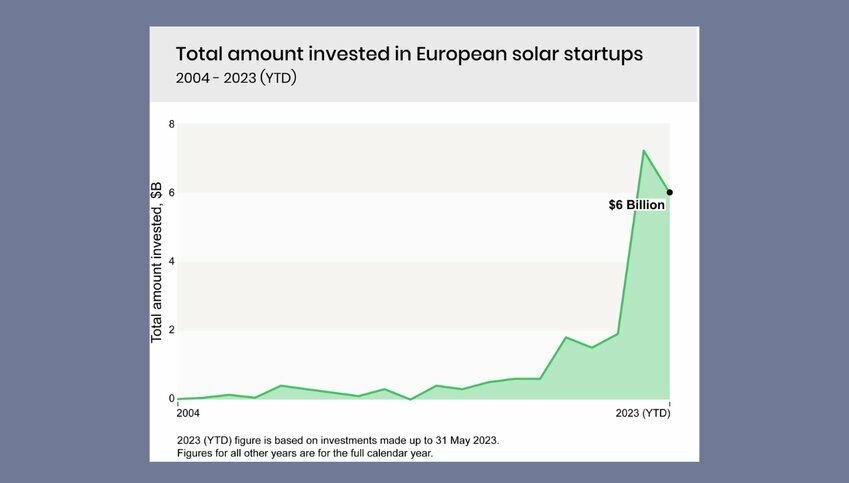

(Credit: Avnet Abacus)European solar startups have witnessed a 398% increase in total investment compared to the previous year, with funding reaching $6 billion by May 2023, according to research conducted by Avnet Abacus.

This surge in financial support indicates the growing demand for solar technology and the innovation opportunities it presents. Avnet Abacus, an electronics distributor that provides consultation to engineers during product design, said investment in the broader renewable energy sector has also seen a significant rise globally, while European venture capital funding experienced a decline.

By the end of 2022, European solar startups had attracted a remarkable $7.2 billion in funding, almost quadrupling the previous year's record of $1.9 billion.

2023 has proven to be equally impressive, with these startups already raising $6 billion, which accounts for 83% of the total funding received in the previous year, and this milestone has been achieved even before the halfway point of the year.

While investment in startups in the renewable energy sector worldwide has increased by 27% compared to the same period last year, Europe experienced a 25% decline amounting to $4 billion. It is noteworthy that venture capital funding across all European startups, regardless of sector, decreased by 66% year-on-year in the first quarter of 2023.

Despite uncertainties in the venture capital market, the average investment in European solar startups has reached an all-time high of $166.1 million. This figure is significantly higher than the average funding of $88.3 million in 2022 and $22.9 million in 2021. The mean amount of venture capital injected into European solar startups so far this year surpasses the global average of $116.8 million and the US average of $113.8 million.

Although wind energy currently generates double the electricity of solar power in the European Union, with wind accounting for 15.9% and solar 7.6% of the energy mix, solar startups outnumber wind-focused startups by almost six times in Europe.

The consumer market is the driving force behind this expansion. Rooftop installations constitute 66% of the EU's current solar capacity, with commercial rooftop panels spreading faster than utility-scale ground-mounted projects. Rising electricity prices have prompted consumers to explore solar energy options, as indicated by the significant increase in Google searches related to the cost of solar panels.

While rooftop and facade panels contribute substantially to Europe's solar capacity, replacing fossil fuels will require large-scale photovoltaic farms capable of generating megawatts of power. Recent advancements in silicon carbide and gallium nitride technologies offer greater efficiency in power conversion compared to traditional silicon-based components, enabling more efficient energy generation in high-power and high-energy-density applications.

Editor’s note: Don’t miss the virtual Environment+Energy Leader Solutions Summit ’23 on July 18-19. Learn tangible, innovative solutions to help with sustainable transitions across industries. Speakers from companies and organizations including Schneider Electric, Cority, Jump Associates, Mycocycle, Plainsight, LRQA, the Alliance to Save Energy, and many more will share tactics and lessons that can help you solve your energy management, sustainability, and ESG challenges. Learn more about the #EESummit23, and then register today!