(Credit: Bloomberg)

(Credit: Bloomberg)A recent Bloomberg survey reveals significant executive interest in increasing ESG spending and overall high corporate prioritization of ESG data. However, firms report difficulties in meeting constantly evolving ESG data content and managing multiple data feeds.

The Data Acquisition & Management Survey 2023 includes responses from more than 100 portfolio managers, climate risk executives, and data management executives. According to these sources, 92% of executives plan to increase their ESG spending by 10% or more, and 18% of executives plan to ramp up ESG spending by 50% or more. Financing toward ESG benchmarks and indices, company-reported data, ESG scores, and sustainable debt are top areas for such spending.

The survey also includes disparities among firms in how they perceive their ESG capabilities, with 64% of respondents considering themselves ahead of competitors and 30% feeling behind. Meanwhile, 99% of respondents cited organizational value of ESG data, especially in wanting to keep pace with peers, achieve a competitive advantage, and for regulatory compliance.

"Once categorized as an alternative data source, ESG data has quickly become integral to the value financial firms deliver to their clients. Executives are making significant strategic investments in ESG data acquisition and management to differentiate themselves and meet client and regulatory demand," said Leila Sadiq, global head of enterprise data content at Bloomberg.

Despite a general consensus on the value of ESG data, challenges remain within the constantly evolving and comparatively new business practice.

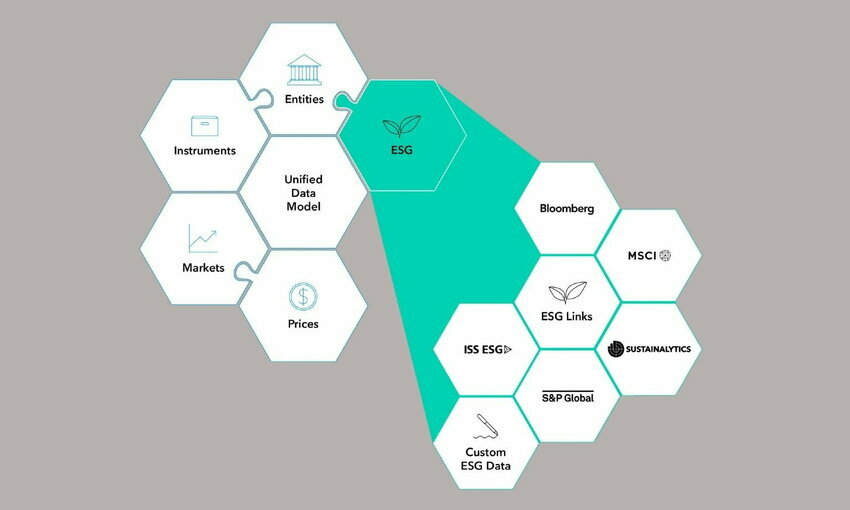

The biggest challenge for firms is reportedly the ever-changing nature of ESG data content (55%), which goes hand-in-hand with other cited concerns: managing multiple ESG vendor data feeds (50%) and aligning ESG content to existing entity data (48%).

Companies reported differing approaches in addressing cited ESG data challenges. 70% of firms reported managing ESG data through a decentralized, or ad hoc, approach, while 29% reported a holistic, firm-wide approach. Further, the preferred entity for the technical delivery of ESG data was found to be the Cloud database (47%).

"As this research confirms, our customers are grappling with the challenge of integrating large volumes of ESG data from multiple sources and the lack of consistency between vendors can lead to data quality issues and operational disruptions," said Don Huff, global head of client services and operations at Bloomberg Data Management Services.